Pacaso: Disrupting Second Home Ownership

The company that lets you buy a house together with up to 7 more people.

Welcome back to Tech Breakdowns and I am so excited that you’re here! If you aren’t subscribed, you can join this new community by clicking here:

Hey folks!

Happy Monday! This week I wanted to cover a new company that is doing something different from the general trending buzzwords in the Silicon Valley. Second homeownership is not for everyone, but it could be. The more I learnt about the idea, the more I wanted to participate in the ecosystem. Let’s get into it.

Pacaso Homes

The Idea

Let’s first understand the meaning of a “second home” in this context. According to your local tax body, a second home may be different from an “investment” home. It is an important distinction to make as second homes carry tax reliefs for the homeowners. Not too dissimilar than many European countries, in the US, to qualify as a second home, the owner must either reside in it for 14 days a year or reside in it for 10% of the total days it was rented out, whichever is higher.

Second homes are a statement of luxury and are reserved for the elitists. Or they were, until now. Pacaso, founded during the height of the pandemic in 2020, is making second homeownership more accessible to the middle-class.

Over 30 million second homes in the US and Europe sit vacant for 10 to 11 months a year. Pacaso lets up to eight people buy a home together. This is accomplished by setting up a limited liability company that owns the property and eight people who own shares in that company. Once a home is sold, Pacaso serves as an “LLC program manager” and undertakes the responsibility for interior designing and scheduling days with your co-owners among other home management responsibilities.

The Origin Story

Austin Allison sold his company to the real-estate marketplace Zillow in 2015 for $108 million. With his share, he purchased a home near Lake Tahoe.

“I felt like I’d achieved a dream,” recalls Allison, who grew up in Cincinnati and built his first company, dotloop, there. “I wanted to make that feeling accessible to more people.”

He soon connected with the person who would understand his mission, the co-founder and former CEO of Zillow, Spencer Rascoff. According to Austin, they named the company Pacaso after being inspired by Pablo Picasso’s work in Cubism which is about bringing together individual elements to create a beautiful collective. Uh, okay.

Second homes are usually located in the vacation spots like near a beach or in the hills or near a ski resort. These are the homes that the company wanted to target. But then the Covid pandemic hit. Now, people weren’t willing to travel in planes to visit these places and instead were looking for getaways and work-from-home locations within two hours of cities.

While the real estate market as a whole may have had a beatdown during the early days of the pandemic, the second home market was flourishing. Many potential buyers were being priced out by this sudden boom in prices.

Pacaso now buys homes itself and then lists them on its marketplace and also sources deals from people who want to buy homes that are for sale and then converts them into a Pacaso.

How It All Works

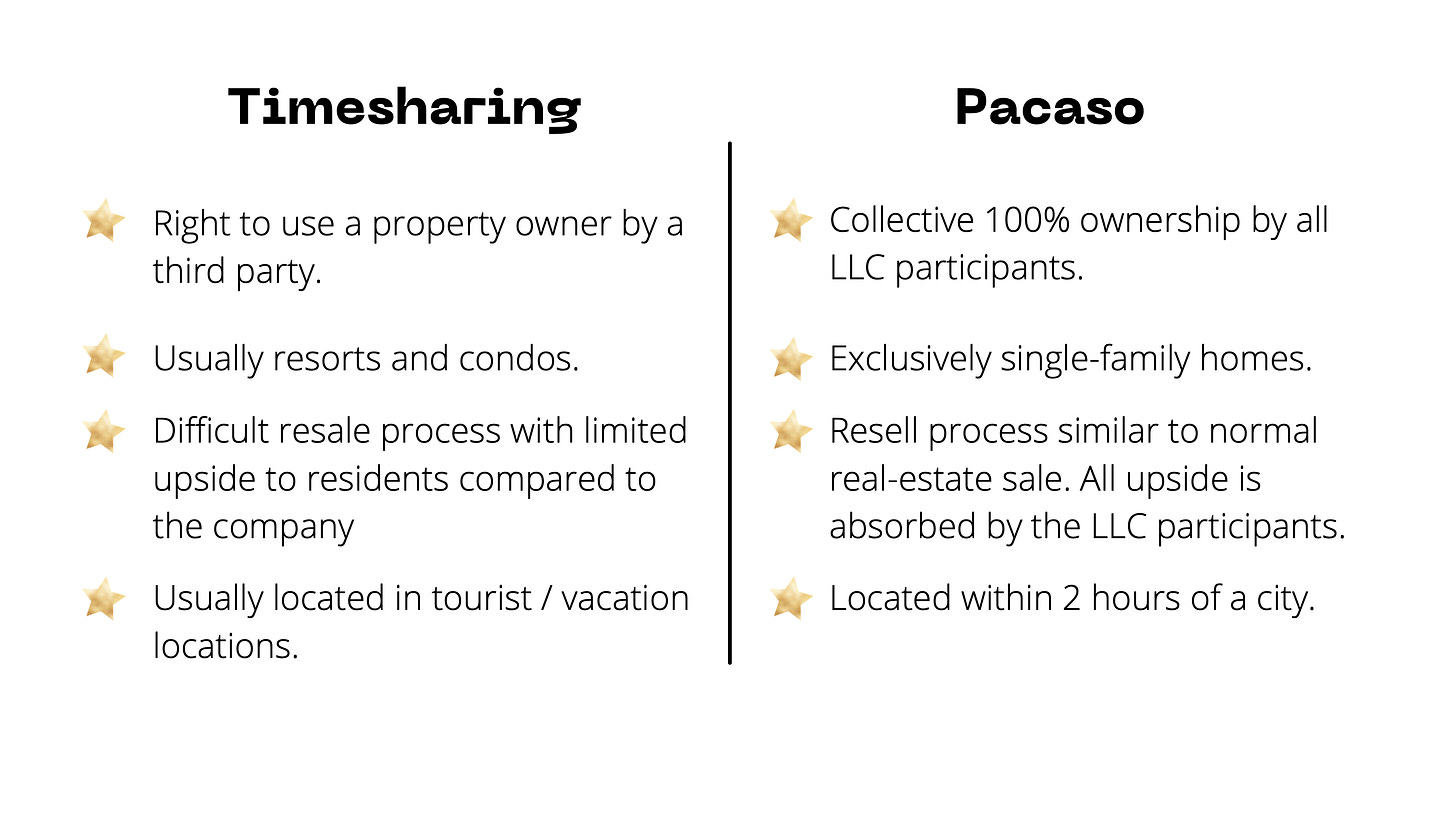

Now, other companies let you do the same thing. Such companies work on a timesharing model. In the timeshare model, a company owns and operates resorts and condos and then leases it out to multiple people or it sells “right-to-use” the property for a set period, usually two weeks a year. People that live here have no ownership right over the property.

Pacaso differentiates itself by letting a few people (between two to eight) that want a second home by letting them have actual ownership through a managed LLC. Owners of a Pacaso property collectively hold 100% ownership. This phenomenon is not new, groups of families and friends do purchase real estate together. Since this is not possible for everyone, Pacaso matches people who are interested in buying a second home together.

Owners of a Pacaso home, book time on their property on a 24-month rolling period by using the Pacaso app which determines the “prime vacation days” and equitably calculates the days each owner gets to spend in their home.

Pacaso charges its customers an annual fee of 1% of the original purchase price to manage and upkeep the homes. Pacaso also makes money by reselling homes to its customers. The latter does seem like a conflict of interest in a way.

Not All Is Good In The Hood

For years now, homeowners have been against the new short-term rental market first created by Airbnb. And now, they are against Pacaso. In many cities around the US, many people have organised groups opposing Pacaso. These groups argue that short-term rentals make their neighbourhoods high-traffic party zones and drive up the prices of real estate. It is not hard to understand the position of these people.

When Airbnb was under similar pressure, it had to ban all parties from its listed places blocking out a demographic. It is also not that hard to foresee the prices of homes in an area going up when a company high on venture dollars starts swooping properties. In defence of Pacaso, while it's true the prices will rise for a single party to buy a home, but the homes, in general, become more accessible for a collective group who otherwise would not have been able to afford a second home individually.

Groups in Napa Valley have found early success in paving-off Pacaso. Citing community feedback, Pacaso decided to sell a home to a single owner instead of the LLC model in Napa. The company also agreed to buy homes only above $2 million in value and to place decibel limiters in home stereo systems to keep the party noises down. The company seems to be taking reasonable steps to accommodate the existing community into its grand vision.

Closing thoughts

I do believe that the residents of Napa Valley will likely not be able to keep Pacaso out of their areas for long, especially not by threatening company executives by sending anonymised notes saying “I will burn down any home you buy in Napa”.

Last week Pacaso raised $125 million from Softbank Vision Fund 2 and is now valued at $1.5 billion. The company claims to be the fastest to achieve unicorn status in just 6 months. Pacaso manages more than $200 million in real-estate on its platform and is present in 25 locations across the US and Europe. With the recently replenished bank account, the company now is focusing on global expansion starting with Spain.

What Else Is Happening

Wall Street Journal’s investigations in Facebook shows that the company knew firstly that its algorithms incentivised outraging and polarising content; secondly, Instagram knew that it was harming teen girls; and Facebook did not remove content that violated its own policies from large accounts to prevent “PR fires”. Link.

Evergrande, China’s second-largest real estate company, is about to default on a $300 billion loan. Wall Street has dubbed it as “China’s Lehman Brothers“. It has already sent the Chinese real estate stock into a spiral. Experts believe this could trigger another global depression like in 2008. Link.

Intuit acquired MailChimp for $12 billion. It is a great bootstrapping story since the founders never raised any venture capital and it is also a sad capitalistic story since the employees had no stock option. Link.

India and Singapore are linking their payment solutions Unified Payment Interface (UPI) and PayNow respectively to facilitate low-cost cross border payments. Link.

SpaceX successfully landed its first all civilian space capsule in the Atlantic ocean. Yay for space travel! Link.

If you think there aren’t enough subscriptions in your life, this new Taco Bell product is for you. Taco Bell is testing a subscription in the US that gives its users access to a taco a day for 30 days. Link.

Carveouts

This week I have two small carveouts:

This video of an asteroid hitting Jupiter. Thank you Jupiter for absorbing all the space rocks that were going to hit Earth. ❤️

I don’t know what I thought an owl without feathers looks like, but this is not what I had imagined.

Trivia

This week’s is right below. Hints are available to those who ask. Be sure to reply with your answer if you get it.

Urvi B was the only one to get the right answer: Intel. Well played!

That’s it for this week. How did you like this week’s Tech Breakdown? Your feedback makes this great.

Loved | Good | Okay | Meh | Bad

If you enjoyed it please don’t forget to share it by clicking the button below. You can reach out to me by replying to this mail or @ShobhitJethani.

If you are new to this community, get subscribed by clicking below:

See you next Monday in your inbox!

Shobhit

Microsoft

Hint for the trivia please