The Theranos Bloodbath

Elizabeth Holmes is on trial for defrauding Theranos investors and lying to patients

Welcome to the first-ever Tech Breakdown. This first edition of the newsletter is going out to 12 people and I am so excited that you’re here! If you aren’t subscribed, you can join this new community by clicking here:

Hey folks!

It’s finally Monday and I hope you have a great week ahead.

Today I wanted to dissect the tale of Elizabeth Holmes and her too good to be true one-drop-of-blood for 100 tests machine. This story has everything, an ambitious Ivy League dropout teenager, $700 million in investment, unjustifiable valuations, fake accents, affairs and fraud. This saga unfolds like a Hollywood movie.

Let’s get into it.

The Theranos Bloodbath

Humble Beginnings

Holmes started Theranos (then called Real-Time Cures) in 2003 at the age of 19 to revolutionise the blood-testing industry. The idea was simple, make blood tests patient-friendly by extracting only a few drops by pricking the finger instead of the usual process of extraction using large needles and vials. The company largely operated in stealth mode until 2013, when it announced a deal with Walgreens Boots Alliance Inc. that would put Theranos “wellness centres” at 41 Walgreens locations in Arizona and California. One of the largest groceries chain in the US, Safeway, spent $350 million developing clinics in 800 of its supermarkets that would be powered by the technology developed by Theranos. At its peak, Theranos was valued at $9 billion.

The only catch: the technology didn’t exist.

Where things went wrong

Since its inception, the company created a culture of extreme secrecy. Anyone that tried to raise a concern about the company’s practices was fired or marginalised. The company ensured its employees could not blow the whistle to the regulators, media and the board of directors by making them sign “airtight” non-disclosure agreements. The employees were even prohibited from discussing work among themselves. In 2015, John Carreyrou at the Wall Street Journal started reporting on the company, and below are the key revelations that have come since:

In 2006, then CFO of the company, Henry Mosley, found out that the company while pitching to Novartis, had prerecorded the demonstration and lied about the capabilities of its first product, Edison.1

The company could only perform one test using “a few drops” of blood, while more than 240 tests offered by the company were tested on large samples of blood extracted from the patient’s arm.

These tests were largely performed on the existing traditional equipment sold by other companies like Siemens Healthcare and the results were claimed to be their own.

Only one of the tests offered was approved by the FDA.

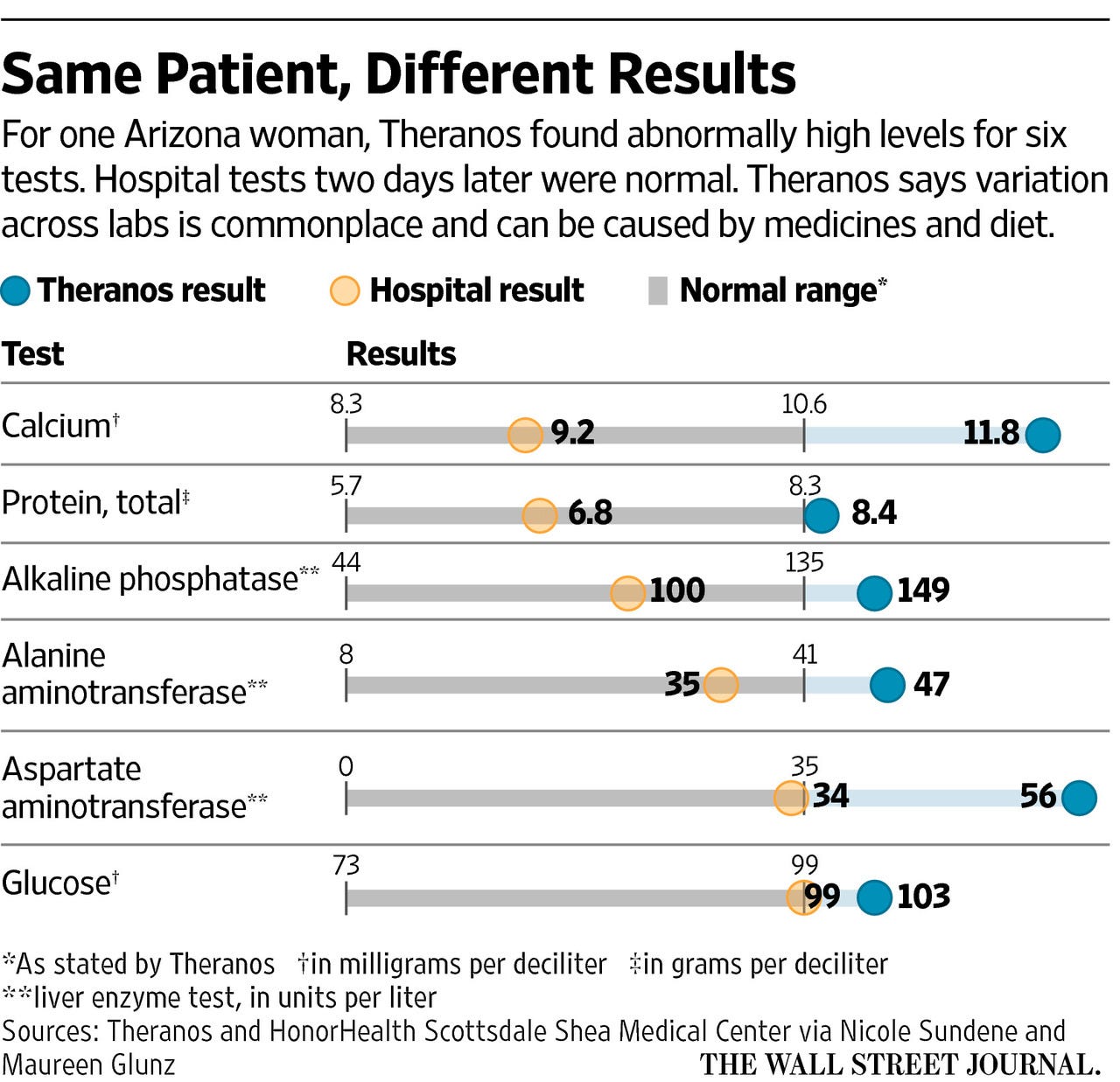

Theranos allegedly knew that the amount of blood collected by finger pricking was too little and had to dilute the samples which skewed the results of the test.

As claimed in its ads to customers, the services offered were not accurate or fast or even reliable.

In 2014, Theranos lied to its investors when they claimed that the company would do $100 million in revenue, a number significantly higher than what the executives at the company expected. Further, Theranos claimed it had signed a contract with the United States Department of Defence that didn’t exist.

Between 2010 and 2015, even though they knew it to be false, Theranos, told its investors that its proprietary equipment could perform blood tests effectively and reliably.

Among other management issues, was the hiring of Sunny Balwani in 2009 for the role of the COO even though Sunny had no prior experience in medical or biological science. Things got worse when it was discovered that Balwani and Holmes had been living together since 2005 and later had started dating without disclosing it to anyone at the company or any of the investors.

A cautionary tale for Silicon Valley

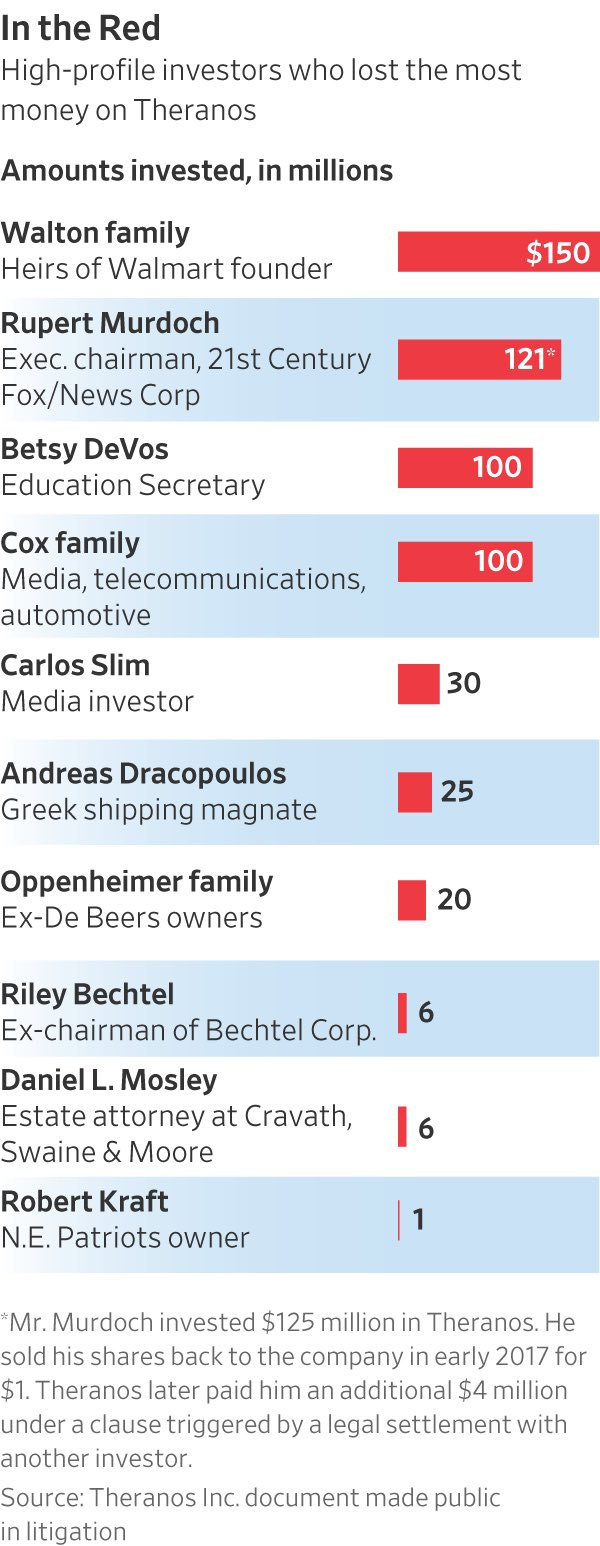

Silicon Valley VCs get a lot of flak for overfunding the company, creating unrealistic valuations, falling for pipe dreams sold by the founders and investing out of FOMO instead of proper due diligence. While the criticisms of this culture are valid (re: WeWork), take a look at the Theranos investors and note how none are the ones who invest for a living2:

Now take a look at the board of directors of the company:

The lack of people with any relevant background in the industry should have been a clear red flag for the investors. It is likely that these people while highly qualified in their respective fields never really understood the severity of the problems at Theranos. This would explain why Holmes was able to get away with so much for so long.

Where we are now

Theranos was dissolved in 2018 after being hit by several civil and criminal lawsuits. Holmes settled with SEC by paying $500,000. Currently, Holmes is under trial for 12 counts of fraud and conspiracy to commit wire fraud. The trial was delayed multiple times due to the COVID pandemic and Holmes’s pregnancy began on Aug 31st. She faces up to 20 years in prison. Now, with the jury for the case selected, the opening statements will be delivered on 8th September. According to newly unsealed documents, Holmes plans to defend herself by arguing that she was subject to emotional and sexual abuse by her ex-partner that impaired her state of mind at the time these alleged crimes were committed. NPR reported that “In particular, Holmes is set to describe at trial how Balwani controlled how she ate, how she dressed and with whom she spoke. … Balwani monitored her calls, text messages and emails and that he was physically violent, throwing "hard, sharp objects" at her.” Sunny Balwani’s trial will begin in Jan’22 after the Holmes trial is closed.

We’ll just have to see how things turn out.

Here’s what else is happening

A new viral messaging app that let you send “gm” to your contacts launched on Monday (30th Aug), signed up 9000 users, got hacked on Wednesday (1st Sept) and then shut down on Friday (3rd Sept). Link.

Apple will let “reader apps” (apps that only allow user sign-in and no sign-ups) redirect users to alternate sources for in-app purchases that are not subject to Apple’s 30% cut. Link.

Big Twitch streamers went on a day-long strike to protest against the company’s lack of action on the latest hate raids on the platform. And viewership dropped, it may have worked. Link.

An internet conspiracy theory that one of the lead characters of the Apple TV show, Ted Lasso, is CGI. It got out of hand and the actor had to clarify that he indeed was real. Link.

Carveouts

I recently finished two seasons of Mythic Quest on Apple TV. It’s a workplace comedy show on the video game studio behind the popular MMO game, Mythic Quest. If you enjoy learning about the development side of video games and you enjoyed HBO’s Silicon Valley, this is the show for you. Link.

The Italian Formula 1 grand prix is on this Sunday. Both the Formula 1 championships (Drivers: Max Verstappen vs Lewis Hamilton and Constructors: Red Bull vs Mercedes) have not been this closely contested since the last few year. Be on the lookout for Ferrari since it is their home race and fans are allowed at the venue after a year long hiatus. Link.

Trivia

Below is the trivia of the week. Hints are available to those who ask. Be sure to reply with your answer if you get it.

That’s it for this week. If you enjoyed it please don’t forget to share it by clicking the button below. My DMs (@ShobhitJethani) are always open for feedback.

See you next Monday in your inbox!

Shobhit

Famously in 2007 during the launch of the iPhone, Steve Jobs (the sole idol of Holmes) had prerecorded many of the proposed features. But it is hard to draw parallels between the technology of a phone and that of a medical testing device.

Tim Draper was an angel investor in Theranos and had reportedly invested $500,000. This could have be in a personal capacity since his daughter was friends with Elizabeth Holmes.

Netscape